Good morning. Here’s what’s happening:

Prices: Bitcoin surged to its highest level since August.

Insights: BLUR, the token of NFT marketplace Blur, surges following an airdrop.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis. And sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.

Prices

Just when bitcoin seemed likely headed for points south, investors sent the largest cryptocurrency by market capitalization upward, largely on the strength of a short squeeze.

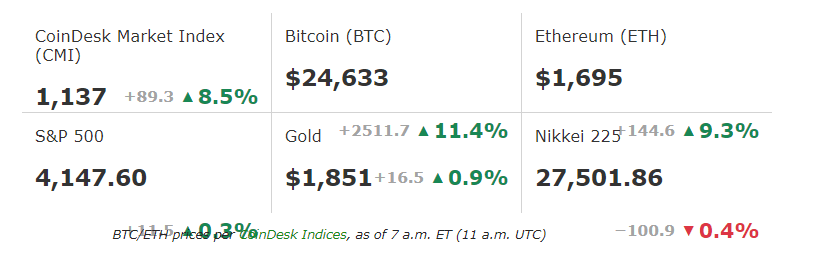

BTC was recently trading at about $24,625, up more than 11% from Tuesday, same time. Bitcoin last traded over $24,500 in August. Wednesday’s spike followed a tepid Consumer Price Index that had investors feeling less anxious about the U.S. economy’s future and the Fed’s next monetary policy moves.

But short-selling investors seemed more responsible for the unexpected reversal from recent days. Data from crypto data provider Coinglass at one point Wednesday showed that traders who bet on price shifts liquidated some $65 million of bitcoin over from the previous 24 hours, from which about $60 million were in short positions.

Ether enjoyed an almost equally upbeat day, blasting past $1,700 before settling slightly below this threshold. The second largest crypto in market value was recently up more than 9%. Other major turned bright green over the course of the day with YGG, the token of play-to-earn gaming guild Yield Guild Games, and NEAR, the native crypto of smart contracts platform Near Protocol, each recently rising well over 11%. The CoinDesk Market Index (CMI) a measure of the wider digital asset market’s performance, was recently up 10%.

And while equity markets were less adventuresome overall with the tech-heavy Nasdaq and S&P 500 both closing up less than a percentage point, crypto related stocks soared with both exchange Coinbase (COIN) and bitcoin miner Marathon Digital Holdings (MARA) increasing 17% and 18%, respectively. Business software company MicroStrategy (MSTR), a major BTC holder, recently rose more than 9%.

The sad saga of FTX continued as U.S. federal prosecutors asked a judge of the U.S. District Court for the Southern District of New York to modify the terms of FTX founder Sam Bankman-Fried’s release on bond to ban him from using cellphones or the internet except under very specific conditions. prosecutors alleged that Bankman-Fried used a virtual private network at least twice, supposedly to watch National Football League playoff games. It’s a sharp escalation of previous requests, which mainly saw prosecutors ask that Bankman-Fried only be banned from using encrypted or ephemeral messaging applications.

In an interview on CoinDesk TV, Joey Krug, investor and co-founder of Augur and Eco, said that he believed “markets had bottomed back in June of last year,” but also noted: “There’s probably going to continue to be some chop in the markets as inflation doesn’t go as fast as people hoped. My view is things got oversold last summer and things are finally bouncing back.”

Krug added: “The second half of the year is going to be bullish for crypto. Most people who are going to sell crypto have already sold.”

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | +14.7% | Entertainment |

| Avalanche | AVAX | +11.4% | Smart Contract Platform |

| Decentraland | MANA | +11.4% | Entertainment |

Biggest Losers

Insights

NFT Marketplace Blur’s Token Reaches $500M Trading Volume After Airdrop

(A version of this story appeared Wednesday on CoinDesk’s website.)

Tokens of NFT marketplace Blur have already amassed over $500 million in trading volume in less than 24 hours since their much-hyped airdrop.

A Blur airdrop tracking page on Dune Analytics, created by Crypto Twitter user pandajackson42, shows that 320 million of the 360 million total airdropped blur tokens were claimed by users, which represents nearly 90% of the airdrop.

Airdrops are the unsolicited distribution of a cryptocurrency token or coin, usually for free, to numerous wallet addresses and are generally used as a tactic to gain users.

BLUR tokens were airdropped to users of the Blur marketplace, with the airdrop amount depending on the total activity, network volume, and transactions made by each user on the platform. There were a total of three airdrop rounds. The first was for everyone who traded in the 6 months prior to the launch of the Blur marketplace, the second was for traders who actively listed on the Blur marketplace through November, and the third was for traders who placed bids on Blur.

The third type of recipient received the most tokens in the airdrop.

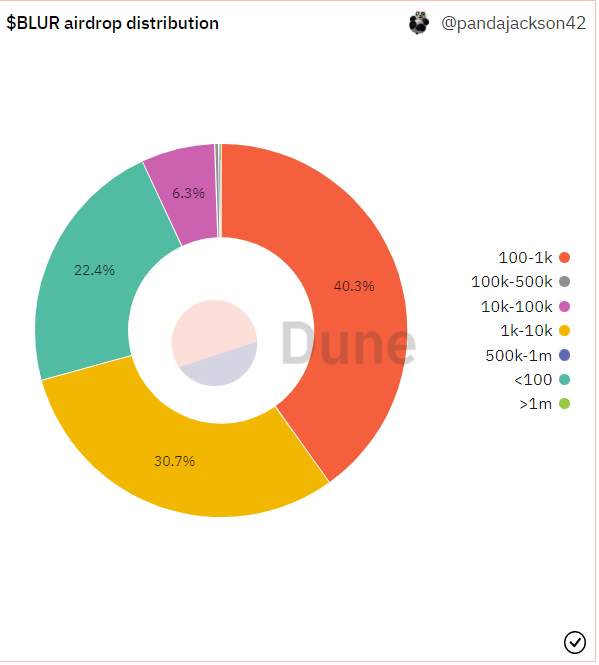

BLUR airdrop distribution (@PandaJackson/Dune Analytics)

Blockchain data further collated on Dune shows 40% of all users received between 100 to 1,000 blur tokens. Some 22% of users received less than 100 blur tokens, while 30% received between 1,000 to 10,000 blur tokens.

Less than 1% of users received more than 1 million blur tokens – worth over $1 million on Wednesday morning.

Blockchain data shows there are over 33,000 unique wallet holders of BLUR as of Wednesday morning, with a majority of these initially receiving the airdrop before likely transferring the tokens out to other wallets.

Some traders sold the tokens en masse after receiving the airdrop. The tokens were initially listed at $1 on crypto exchange Coinbase, but fell to as low as 48 cents late on Tuesday. However, Asian hours on Wednesday saw buying pressure and the tokens rose to 72 cents as of writing time.

CoinGecko data shows over $530 million worth of BLUR has been traded across exchanges such as OKX, Kucoin and Uniswap.

Meanwhile, the total value of tokens on the Blur marketplace spiked by $10 million in the past 24 hours, DeFiLlama data shows.