Maverick’s rewards system lets token issuers target a specific price range, offering more efficient incentives than rival Curve Finance and helping pegged assets such as stablecoins, liquid staking derivatives keep their prices stable, the protocol said.

Decentralized exchange (DEX) platform Maverick Protocol has unveiled a novel incentive system that can help stablecoins and ether (ETH) liquid staking derivatives keep their price pegs, the protocol said in a press release on Tuesday.

The incentive system allows token issuers such as liquid staking protocols or stablecoin issuers to create so-called “boosted positions,” offering extra rewards to liquidity providers in a customized price range in Maverick’s liquidity pools.

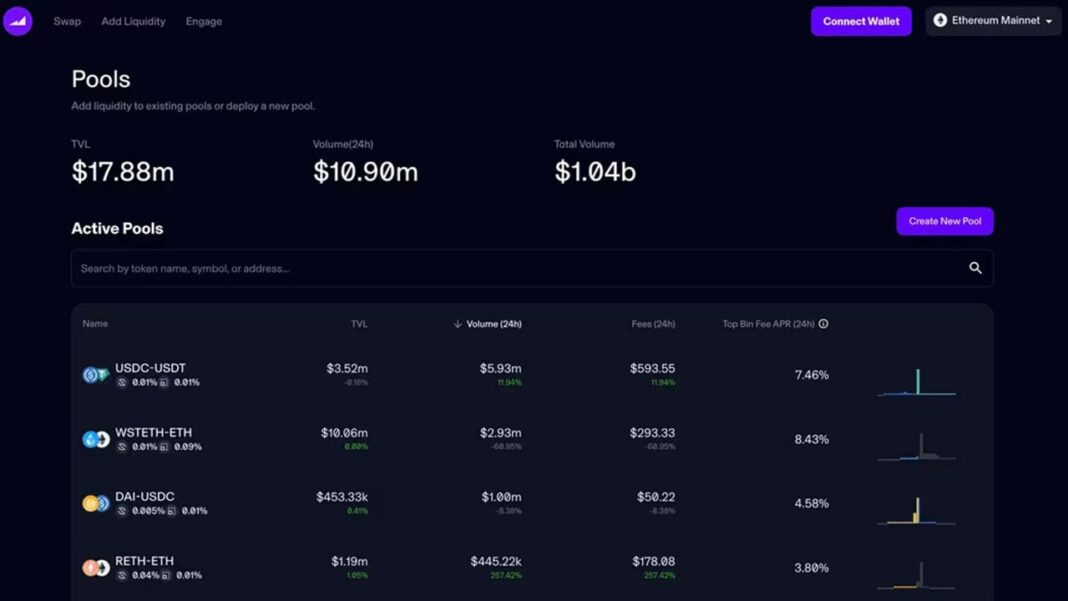

Maverick is built around an automated market maker (AMM) algorithm, where traders can swap digital assets without any intermediary in liquidity pools. Token holders can also deploy their assets in the pools to provide liquidity for trading while earning a share of the trading fees.

The protocol’s latest upgrade comes as decentralized exchanges (DEX) are fiercely competing to attract traders and traffic onto their platforms as crypto investors seek decentralized trading venues after multiple blowups of centralized marketplaces and increasing regulatory stranglehold.

To do so, some DEXs offer extra rewards on top of the transaction revenues to liquidity providers to deploy their capital, such as Curve Finance’s “gauge” system. These rewards are generally paid by the token issuers in the liquidity pool.

However, “current incentive systems are too blunt,” Bob Baxley, core developer of Maverick, said.

Maverick’s tool is more efficient than existing offerings because it allows token issuers to concentrate reward payouts to a certain price range and build price walls, Baxley explained in an interview.

This can also help pegged assets such as stablecoins and liquid staking derivatives keep their prices more stable, while liquidity providers can earn additional revenue, according to the press release.

Token issuers, such as decentralized finance (DeFi) protocols or stablecoin issuers, can pay out rewards in the form of any token of their choice over a period between three and thirty days, the press release said.

For example, Lido Finance, the largest ether (ETH) liquid staking protocol and issuer of the stETH token, has already approved to deploy incentives to Maverick’s wstETH-ETH liquidity pool in May, paid out in Lido’s governance token LDO, according to a Lido governance forum post.

Baxley said the development would help position Maverick as the go-to marketplace for ETH liquid staking derivatives after the highly anticipated Shanghai upgrade, which allowed users to withdraw locked-up tokens from the Ethereum blockchain. Liquid staking lets investors earn staking rewards while maintaining their ability to borrow and lend with a derivative token representing their locked-up assets in staking.