Binance USD, the Paxos-issued stablecoin under the brand of the world’s largest crypto exchange by trading volume, fell to $9.5 billion market capitalization on Friday, data from CoinGecko shows.

This is the first time BUSD’s circulating supply has gone below $10 billion since June 2021.

Demand for BUSD has been rapidly declining since Paxos announced on Feb. 13 it would stop minting new BUSD tokens, citing orders from state regulator New York Department of Financial Services (NYDFS). Separately, the U.S. Securities and Exchange Commission (SEC) was reportedly preparing to sue Paxos for offering unregistered securities.

Blockchain data by crypto intelligence firm Nansen shows that investors have redeemed some $6.7 billion of BUSD from Paxos since Feb. 13.

As a result of the falling demand, dogecoin (DOGE) replaced BUSD as the ninth-largest cryptocurrency by market capitalization, according to CoinMarketCap.

BUSD liquidity concerns

U.S.-based crypto exchange giant Coinbase announced this week that it will pause trading of BUSD on the platform starting March 13. Coinbase Chief Executive Brian Armstrong cited liquidity concerns for delisting the stablecoin.

“Coinbase’s decision to delist was likely made as a precaution in anticipation of a future drop in liquidity or operational concerns around redemptions,” Clara Medalie, director of research at crypto market research firm Kaiko, told CoinDesk.

The daily trading volume for BUSD on Coinbase was only about $9 million in the last two months, while the market depth within 2% of the market price was just $600,000, according to data from Kaiko, making the stablecoin’s price vulnerable to wobbles. Market depth represents the open buy and sell orders for an asset within a certain price range; the deeper the market, the more stable the price is.

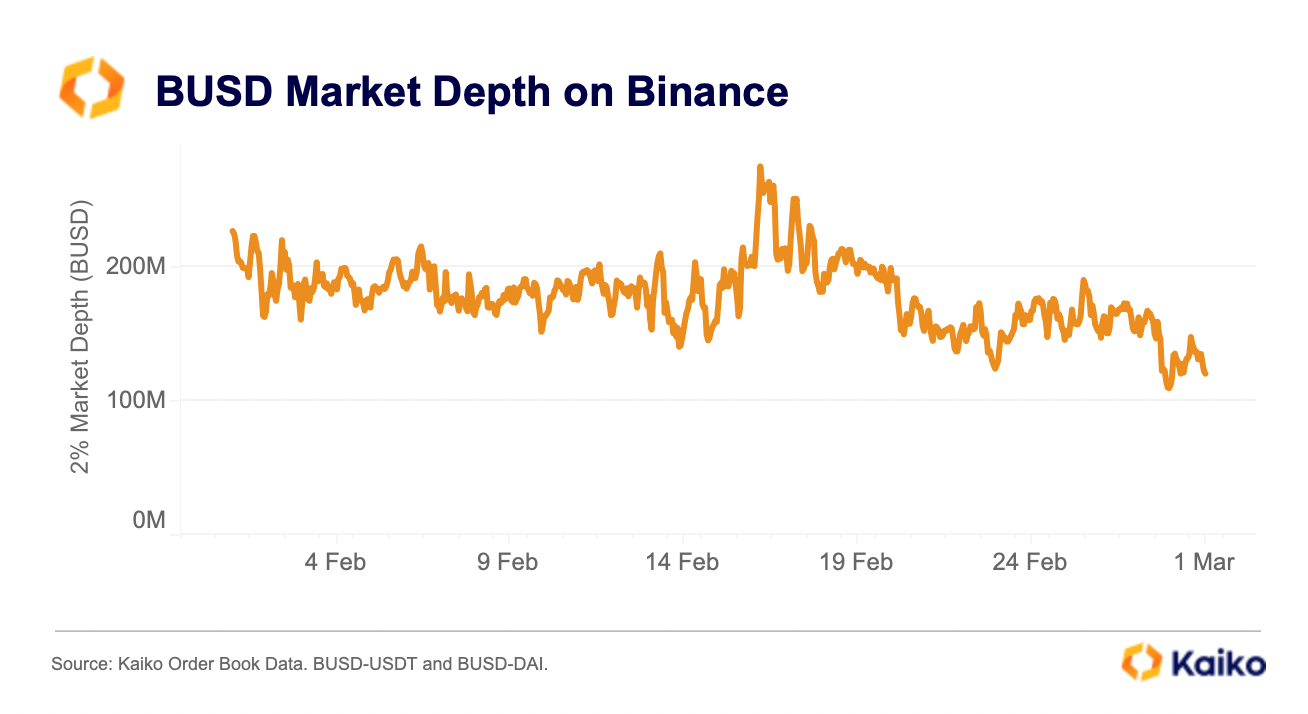

BUSD liquidity on Binance, the stablecoin’s main market, significantly deteriorated last month.

Kaiko data shows that market depth within 2% for BUSD-USDT and BUSD-DAI stablecoin pairs has fallen to $123 million from $200 million in February before the Paxos announcement.

“The overall liquidity is very thin,” Medalie said, “which is not great for a stablecoin that should theoretically always trade 1:1” with the U.S. dollar.