Bitcoin (BTC) reached a session high of $43,300, its highest level in almost three weeks, as bullish sentiment improved among crypto traders.

Some alternative cryptocurrencies (altcoins) also edged higher on Tuesday, even as alts’ recent gains against bitcoin were starting to fade. For example, ether (ETH), the second-largest cryptocurrency by market capitalization after bitcoin, rose above $3,000 for the first time in two weeks and was up 3% over the past 24 hours, compared to a rise of as much as 4% in BTC over the same period. Meanwhile, Terra’s LUNA token was down 3% over the past 24 hours.

But some analysts remain cautious despite the recent price rise. “This is not the first such jump in BTC since the beginning of March, in contrast to the neutral or even negative sentiment in the stock markets,” Alex Kuptsikevich, an analyst at FxPro, wrote in an article. “Until now, such impulses cannot be on a solid basis, because the fundamental demand for risks is under obvious pressure.”

Elsewhere, global equities traded higher on Monday while gold, a traditional safe haven, declined. The 10-year Treasury bond yield continued higher, tracking gains in oil prices as investors position themselves for high inflation and rising interest rates.

Latest prices

●Bitcoin (BTC): $42,365, +2.77%

●Ether (ETH): $2,991, +2.41%

●S&P 500 daily close: $4,512, +1.13%

●Gold: $1,921 per troy ounce, −0.38%

●Ten-year Treasury yield daily close: 2.37%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Tactical shift in altcoins

Is “altcoin season” making a comeback? Not quite.

For now, some analysts see the potential for a short-term relief rally in altcoins, which could signal a greater appetite for risk among crypto investors. Altcoins tend to outperform in bull markets because of their higher risk profile relative to bitcoin.

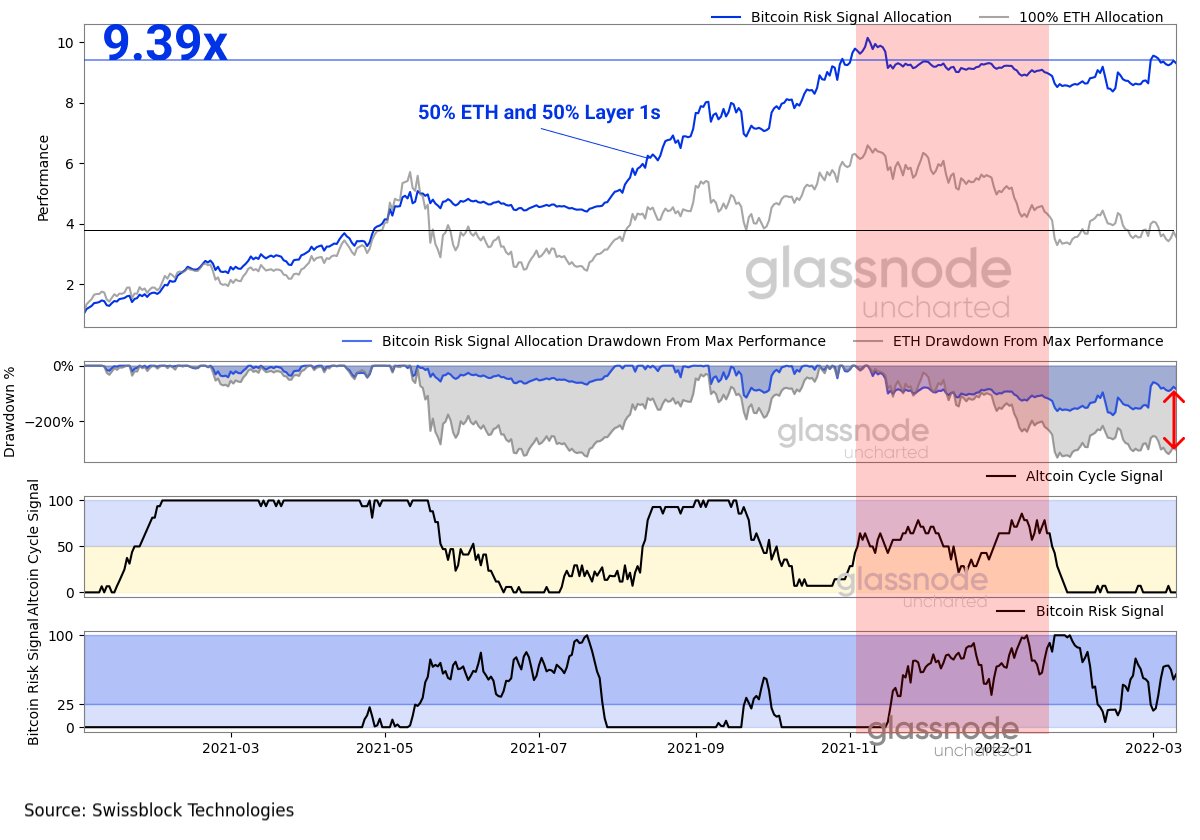

The chart below shows the cycle in bitcoin and altcoins over the past year. When Glassnode’s risk indicators reach extreme highs, a greater allocation to bitcoin is warranted, similar to what occurred earlier this year. In contrast, when risk is low for an extended period of time, traders tend to shift toward altcoins as sentiment improves.

Currently, the risk signal (see last panel below) is still above 25, which does not suggest an aggressive rotation to altcoins. Read more here.

Bitcoin risk signals (Glassnode/Swissblock Technologies)

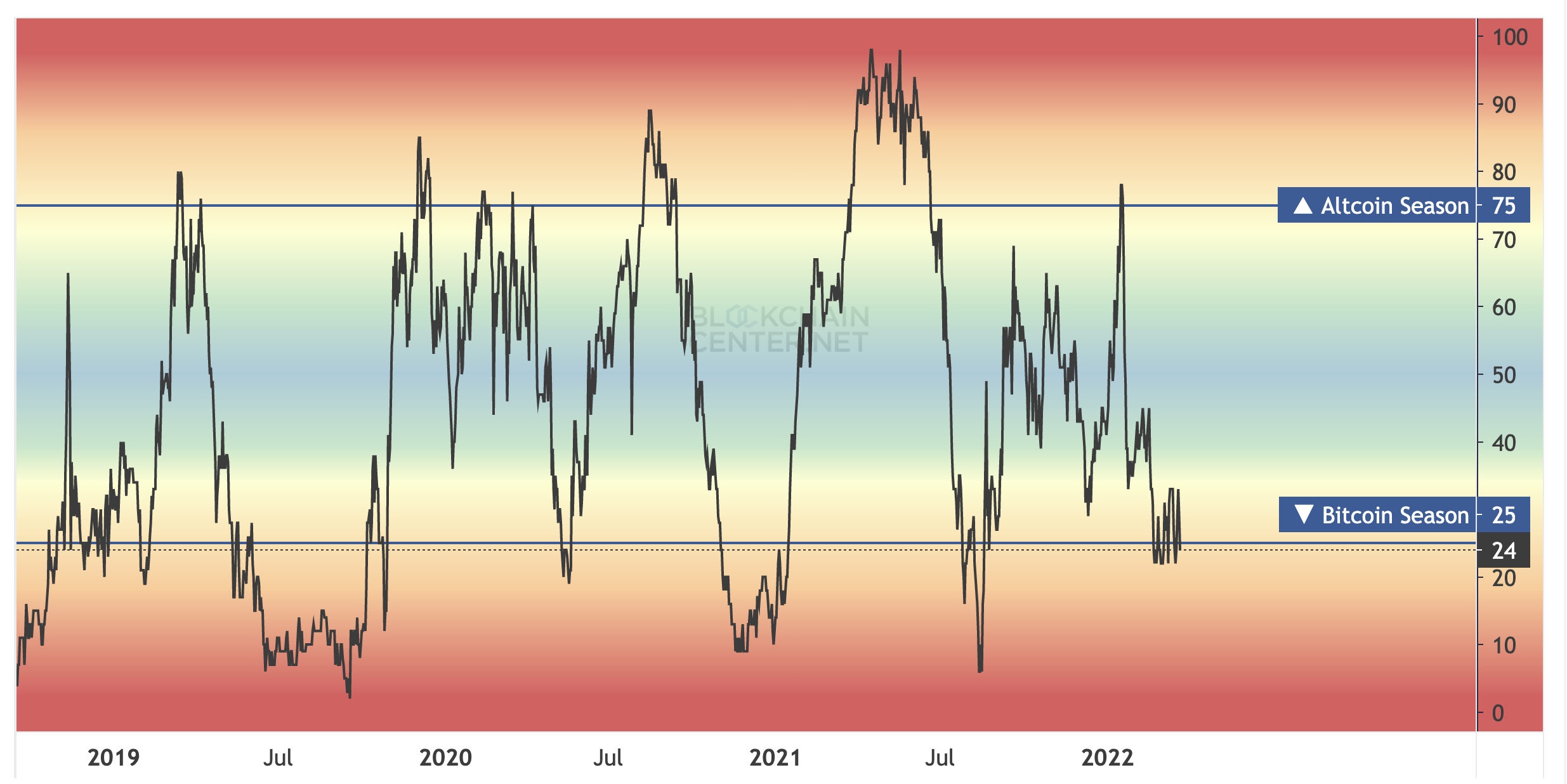

And here is the Altcoin Season Index by Blockchain Center. So far, roughly 25% of the top 50 coins are performing better than bitcoin over the past 90 days, which is below the 75% threshold to signal a bullish phase for altcoins (possibly too late for traders looking for a new trend).

Instead, based on previous cycles, altcoins tend to sustain their outperformance once the indicator crosses above the 50% neutral mark.

Altcoin Season Index (Blockchain Center)

Crypto stocks race ahead

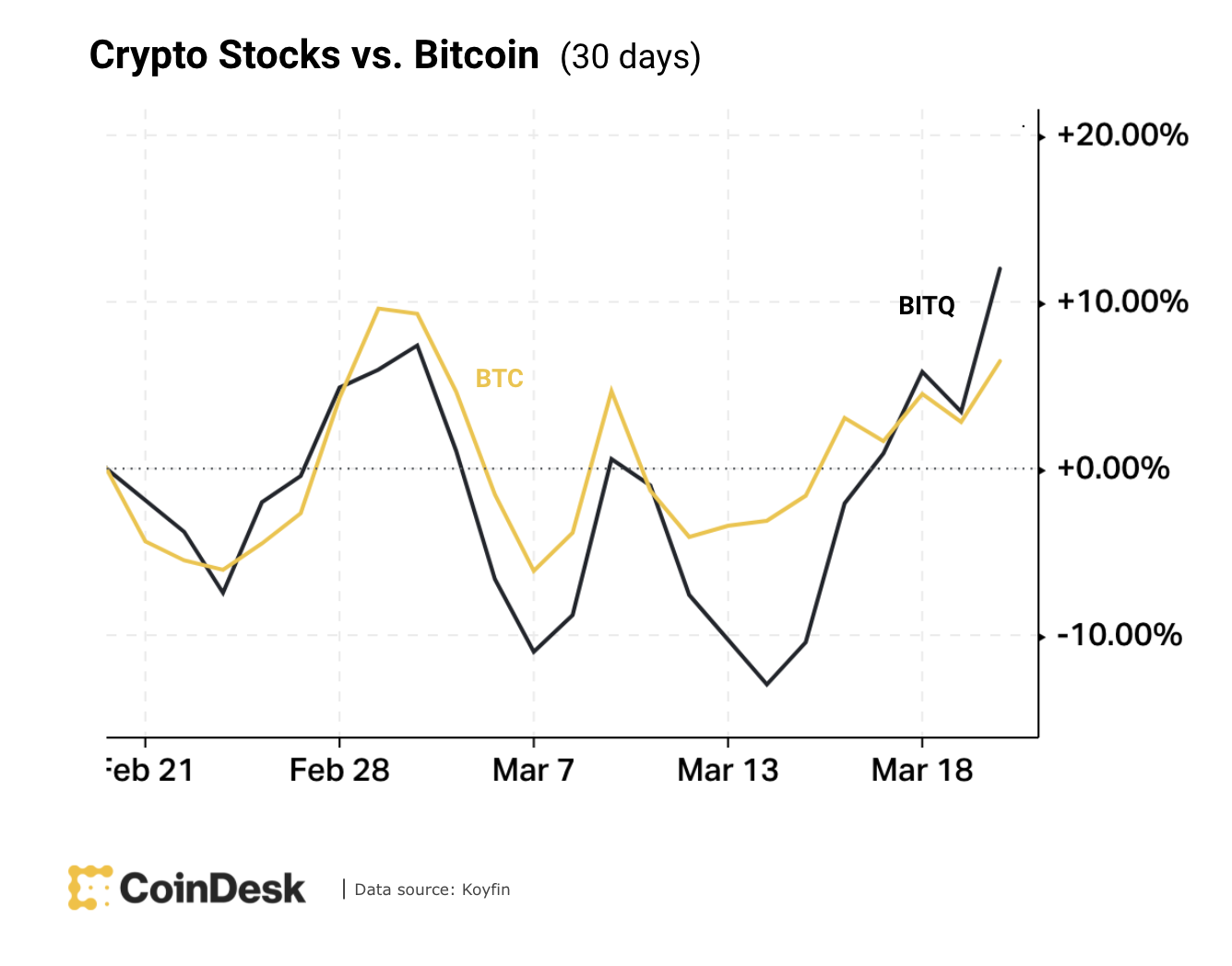

Another indicator of investor appetite for risk is the performance of crypto-related stocks relative to BTC.

The chart below shows the recent outperformance of the Bitwise Crypto Industry Innovators exchange-traded fund (BITQ), which tracks the performance of companies that generate the majority of their revenue from their crypto business activities. BITQ is now ahead of BTC over the past 30 days, which typically signals a bullish turn in crypto markets.

BTC vs. BITQ (Koyfin)

Altcoin roundup

-

Polychain Capital leads $22M investment in NFT appraisal protocol Upshot: Upshot, a protocol that provides non-fungible token (NFT) appraisals, has raised $22 million in a Series A2 funding round led by Polychain Capital, Evaluating the value of an NFT is a complicated task because the answer is essentially “what someone is willing to pay.” Pricing data, however, is important to have both as a potential NFT trader and for developers exploring the intersection of decentralized finance (DeFi) and NFTs, according to CoinDesk’s Brandy Betz. Read more here.

-

$1 billion in loans issued on Maple in just 10 months: Maple, a protocol that enables undercollateralized loans for institutional borrowers, announced that $1 billion in loans have been issued on the protocol. Launched in May 2021, Maple’s debt-capital market infrastructure is intended to enable credit experts to launch and grow healthy lending businesses. Participants on Maple are market makers and market-neutral funds. They plan to move to be multi-chain as it launches on Solana in the near future. Read more here.

-

mStable’s Process Quality Score was rated 93% from DeFiSafety: mStable, which calls itself a decentralized stablecoin ecosystem, was given a Process Quality Score (PQR) of 93%, putting it among the top 5% of protocols reviewed by DeFiSafety. The independent ratings organization evaluates decentralized finance products to produce a security score based on transparency and adherence to best practices.