It’s probably not surprising to hear that non-fungible tokens (NFTs) and cryptocurrency go hand in hand. NFTs are a type of token, after all. And when it comes to buying and selling NFTs, crypto is the de facto currency used to transact on the blockchain.

But where are people getting all their crypto from? Does it just magically appear in their wallets? Well, sometimes! But the vast majority of individuals go through traditional providers to buy and sell crypto. The most common place to begin is at a crypto exchange; however, you can also use a crypto broker or more traditional payment services to buy crypto.

You don’t need to be an expert on blockchain tech to select a provider and make a purchase, but knowing the different places and ways to trade crypto can be a big help when building your portfolio. In this guide, we’ll tell you everything you need to know to find the crypto trading service that’s right for you.

A guide to crypto exchanges ≠ investment advice

If you’re reading this guide, it’s pretty likely that you’re looking to buy crypto to use in the NFT ecosystem. If so, you’ve come to the right place. At its core, nft now is all about providing the insights individuals need to thrive in the fast-paced world of NFTs. That said, this overview of crypto exchanges is meant for anyone who is interested in trading crypto. This article breaks down how the various kinds of crypto exchanges function, their benefits and drawbacks, and lists some of the top providers in each category.

But before we begin, we need to state the obvious.

The crypto market is volatile, so please make sure to do research before purchasing any crypto. This isn’t a guide to what crypto you should buy and sell. Rather, it is a clear “how-to guide” that outlines the different places you can buy and sell crypto. As always, you should consult your financial adviser before making any decisions.

What is a crypto exchange?

Put simply, a crypto exchange is a platform that allows users to buy and sell cryptocurrencies like Ether, Bitcoin, and Dogecoin. They tend to function a lot like traditional stock markets and brokerage firms do, except that users are obviously trading cryptocurrency instead of stocks.

There are several robust exchanges that double as trading platforms, like Coinbase or Gemini. These are the more traditional crypto exchanges and where most beginners start. However, they are far from the only trading platforms. In fact, traditional payment and money sending services, such as Venmo and Paypal, recently added interfaces that allow users to trade crypto. Then there are also online brokers.

To select the best exchange for your needs, one of the most important concepts to grasp is the difference between centralized and decentralized exchanges.

What is a centralized exchange?

Overview: Centralized exchanges (CEX) are platforms that let buyers and sellers trade cryptocurrencies with each other based on current market prices.

They are called “centralized exchanges” because they’re managed by one entity. All of the most popular are also businesses registered with official governments. As a result, they are required to adhere to financial regulations from governmental authorities, such as the Securities and Exchange Commission (SEC), and you’ll need to provide identification and verify your bank account in order to use them. In short, each centralized exchange has its own unique sign-up and verification process that you must go through before accessing its full roster of services.

Benefits: One of the benefits of a centralized exchange is that they offer a robust array of ways to trade. You can buy and sell in your local currency, and they usually support payments via bank account, credit and debit card, and wire transfer. When cashing out from an exchange, you’ll likely receive the money directly to your bank account. Another benefit of the more popular centralized exchanges is that they are beginner-friendly. So you can sign up and start trading in no time. They also provide some insurance in the event that their system fails.

Drawbacks: The problem with centralized exchanges is that they run on their private servers. This is an issue for two reasons. First, it doesn’t align with the decentralized ethos of blockchain and Web3. Providers can freeze your account if they think your activity is suspicious or illegal (even if it’s not). Second, because they are centralized, this creates a vector of attack – essentially, a path for hackers to exploit their vulnerabilities. However, as mentioned, they do generally offer insurance if they are compromised and found to be at fault.

The top centralized crypto exchanges

Coinbase

Coinbase is a centralized exchange and the largest crypto exchange in the United States. It is one of the best places for beginners for several reasons. The platform offers access to more than 100 cryptocurrencies, which is a great benefit. It also adds new currencies on a consistent basis, and the company is very diligent when it comes to determining what crypto to add. It takes pains to avoid coins that have red flags. Coinbase also has an extremely easy-to-use interface.

For these reasons, Coinbase is one of the most popular exchanges among those in the NFT community. Fees vary from 0.5% – 4.5% depending on the type of transaction.

Binance

Binance is a centralized exchange founded in Hong Kong and now located in the Cayman Islands. The international service hosts trading for more than 600 coins and virtual tokens. Transaction fees start at 0.10%. Ultimately, it is best suited for slightly more advanced users who want to trade or invest in lesser-known altcoins.

One thing to note is that the platform was banned in the U.S. in 2019 on regulatory grounds. As such, U.S. users don’t have access to the original Binance site or services today. They can only trade around 65 cryptocurrencies via Binance.US. Fees vary from 0.1% – 5% depending on the type of transaction.

Gemini

Gemini is another privately-owned crypto exchange based in the United States. The platform hosts over 70 tradable coins and is also the parent company on the highly-popular NFT marketplace Nifty Gateway.

Fees vary from 0.5% – 3.99% depending on the type of transaction.

Crypto.com

Crypto.com is a centralized exchange based out of Singapore. It supports the trading of more than 250 types of currencies. The platform started gaining revitalized popularity in 2021 through a series of influential ads. Notably, the website made headlines by signing a 20-year deal with the iconic Los Angeles arena formerly known as the Staples Center — now the Crypto.com Arena. Fees vary from 0.04% and are volume-based.

FTX

FTX is another leading centralized crypto exchange. This exchange was founded in 2019 and has its headquarters located in The Bahamas. FTX supports the trading of around 275 cryptocurrencies with only 24 coins tradeable in the U.S. Fees vary from 0% – 0.4% depending on the type of transaction. A full breakdown of FTX’s fees can be found here.

What is an decentralized exchange?

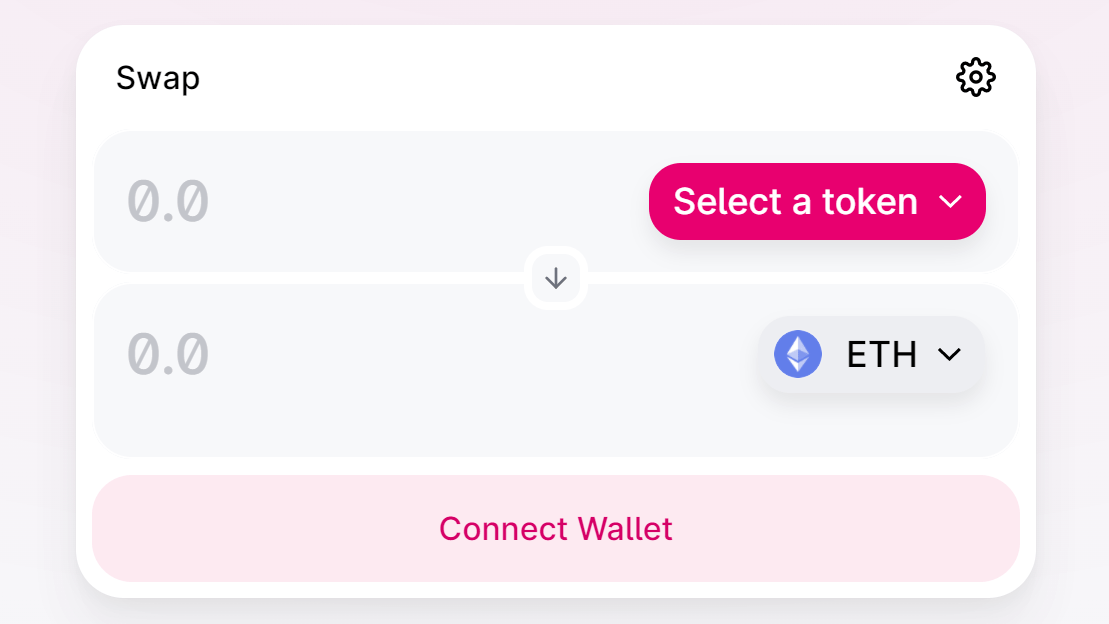

Overview: Like centralized exchanges, decentralized exchanges are platforms that let buyers and sellers trade cryptocurrencies with each other based on current market prices. However, a decentralized exchange facilitates crypto transactions on the blockchain. Since they use the blockchain, decentralized exchanges have no central authority or point of control. Instead, each computer acts as part of the server.

Benefits: Decentralization is the most notable benefit for several reasons. First, if one computer goes offline, it doesn’t affect the network. All the other computers will continue to run things smoothly. Second, no specific person or organization controls the decentralized system. That means that no one can stop you from accessing services or ban your account. Third, these exchanges aren’t subject to rules made by regulatory bodies, so you won’t need to identify yourself to use them. That, of course, is a great benefit for people without government identification or who are living under an oppressive regime. Decentralized exchange fees are notoriously low.

Drawbacks: In short, because no single entity runs them, there is no one to hold accountable on decentralized exchanges. That means there is no insurance and no one to pursue if something goes wrong. Additionally, although the fees are lower, you’ll already need to own a bit of crypto to utilize these exchanges. That isn’t a major hurdle though.

An easy way to start swapping via a decentralized exchange is to use a card or payment service on a centralized exchange to purchase a small amount of stablecoin (a type of cryptocurrency that attempts to peg market value to some external reference i.e. $1 = 1 USDC).

Alternatively, you can purchase crypto directly to your blockchain-specific wallet, like Ethereum’s MetaMask wallet, and get trading immediately. Once you have your crypto wallet funded, you can then connect it to a decentralized exchange — much like you’d connect to any other Dapp (decentralized app) — and utilize the services interface.

The top decentralized exchanges for trading crypto

Bisq

Bisq is a decentralized, open-source exchange that doesn’t have any identification requirements. As a result, it’s a great option for people who don’t have government identification or are living under an oppressive regime. This peer-to-peer exchange also has more than 20 different payment options and a mobile app for both iOS and Android, so anyone with a device can instantly access it.

Their fees are between 0.05% and 0.70%.

Uniswap

Uniswap is one of the leading decentralized exchanges on the Ethereum blockchain. Usually, the service charges a flat fee of 0.30% for swaps, but it supports a wide variety of swapping and liquidity services.

SushiSwap

SishiSwap is another DEX hosted on the Ethereum blockchain. The platform allows for swapping, stacking yields, lending, borrowing, and more all in one place. Expect to pay a 0.25% fee for swaps.

PancakeSwap

PancakeSwap is one of the biggest and most popular DeFi (decentralized finance) protocols and is hosted on the Binance Smart Chain. You will pay about a 0.25% fee for swaps.

What is a crypto broker?

Overview: A crypto broker is a centralized service that acts as an intermediary between a user and the cryptocurrency markets to facilitate the buying and selling of cryptocurrencies. As a result, users aren’t trading with each other based on current market prices. Instead, the price is set by the broker.

Benefits: When using a crypto broker, users don’t need to trade their own deposited crypto or fiat currency. Instead, they can use another trading pair. In other words, if you put in bitcoin and wanted to leverage trading on the ETH/XRP pair to complete a transaction, you don’t have to trade your bitcoin for ETH first. A brokerage is a good option for users trading in high volume precisely because there is more liquidity i.e., there are various trading opportunities including leverage positions.

Brokers also generally offer lower withdrawal and trading fees.

Drawbacks: Crypto brokers have many of the same issues as centralized exchanges: you need to identify yourself, your account can be barred, etc. Although brokers offer lower fees, crypto is traded in significantly higher amounts. This means that, at the end of the day, the absolute amount of fees could be a similar size. Brokers are also generally better suited for advanced users (not beginners), but it depends on the specific provider.

Top crypto brokers

Bitpanda

Bitpanda was founded in 2014 in Vienna, Austria. The platform offers users both a broker and an exchange platform. To use Bitpanda, sign up using your email address, verify your account, choose from a range of payment methods to deposit fiat funds, then start buying and selling digital assets. You can see a breakdown of fees here.

Robinhood

Robinhood is a U.S.-based broker platform that lets users purchase stocks and altcoins. It is one of the most popular platforms; however, users can’t withdraw crypto funds from their Robinhood accounts. Instead, users have to sell their coins and transfer the balance to their external accounts. There are no commissions, but users must pay an order flow fee that varies by trade.

Trading crypto using payment services

Overview: For those who want to find the absolute easiest method to purchase crypto, using one of the popular payment apps could be the way to go. If you’ve sent money over the internet in the past decade, chances are you already have an account with one of these major services.

Before jumping head-on into a buy, make sure to do your due diligence in considering the fees that could be incurred through buying crypto on a payment app. Also, consider that each of these payment apps is a centralized way to purchase crypto, similar to the centralized exchanges like Coinbase, Gemini, and the others listed in the previous section.

The top payment services for trading crypto

Cash App

Recently, Cash App created interfaces that enable users to buy and sell Bitcoin with ease. The obvious drawback of purchasing crypto via Cash App is that you can only buy Bitcoin and fees can get a bit high, depending on the amount you wish to purchase. An explanation of Cash App’s fees can be found here.

Venmo

Venmo allows for the purchase of Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Similar to Cash App, fees vary depending on the amount you want to purchase, increasing alongside the intended purchase amount. They typically vary from 1.5% – 2.3%.

Paypal

Similar to Venmo, Paypal also only allows for the purchase of Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. And, as is the case with the other two apps mentioned on this list, when purchase amounts go up, so do fees. Fees vary from 1.5% – 2.3%.

Wyre

Another great way to purchase crypto is to use a service that deposits crypto directly into your wallet. Wyre is a payment service that can be utilized via OpenSea or MetaMask directly. The interface is simple and allows users to purchase a wide variety of coins using a credit or debit card in a range of national currencies. For a better overview of setting up an Ethereum wallet and using Wyre, read our guide on how to set up a MetaMask here. A full breakdown of Wyre’s fees can be found here.

Moonpay

Moonpay is another option when it comes to direct depositing crypto into your software wallet. The company is known for its high-profile partnerships and relentless onboarding of celebrities. The interface is similar to that of Wyre, with the exception being that Moonpay only supports the purchase of Ethereum. For those with the primary goal of collecting ETH NFTs, Moonpay could work well for you. A full breakdown of Moonpay’sfees can be found here.

Go buy some crypto

As we mentioned before, this is not a guide to trading crypto, but a simple how-to on purchasing and selling coins in various ways. The crypto market is volatile and should be researched prior to becoming involved.

Now that you have your first bit of crypto, it’s up to you how you put it to use. Will you hold for the long term and watch the charts go up and down? Will you stake your coins in hope of earning rewards? Or will you hop, skip, jump straight into the NFT ecosystem? Of course, the choice is yours. If you are hoping to get started in NFTs though, make sure to take a look through our list of some of the best starter projects currently on the market.