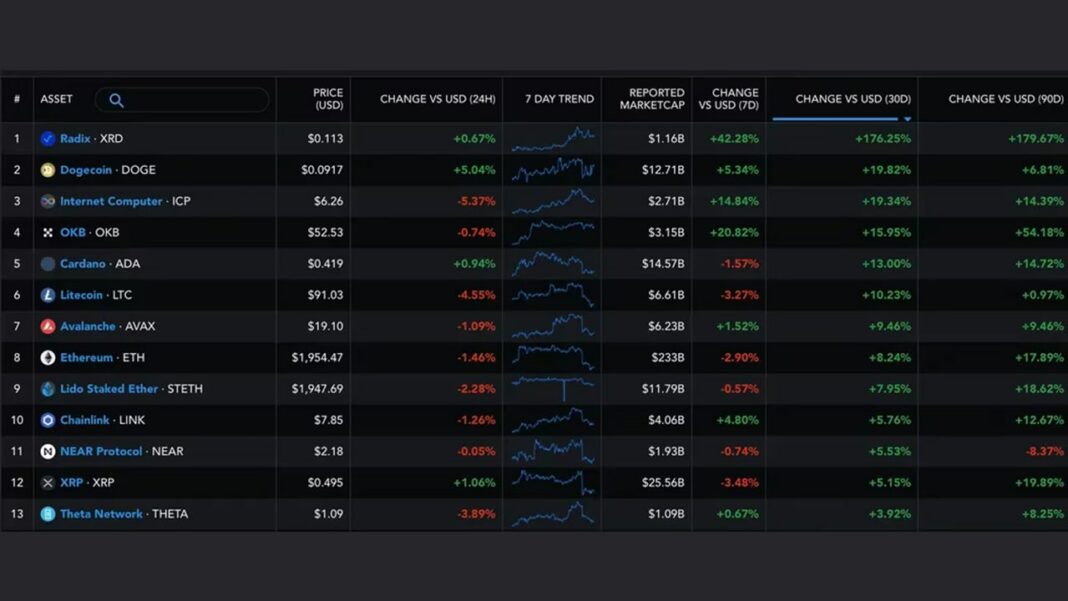

Decentralized finance-focused distributed ledger Radix’s XRD token has more than doubled in the past 30 days, becoming the best-performing top 100 cryptocurrency during that period.

XRD has rallied by 176% to 11.4 cents, with the price reaching a 12-month high of 15 cents at one point, Messari data shows. The rally has lifted the cryptocurrency’s market capitalization to $1.16 billion, making it the 46th-largest coin in the market. In four weeks, market leaders bitcoin (BTC) and ether (ETH) have gained 2.6% and 8.2%, respectively, while the total crypto market capitalization has increased 5% to $1.18 trillion.

Radix’s March fundraising, led by market maker and investment firm DWF Labs, and optimism about an impending upgrade seem to have galvanized investors’ interest in the token, according to Markus Thielen, head of research and strategy at Matrixport. The financing round gave Radix a valuation of $400 million.

“Radix raised $10m in funding ahead of the launch of its Babylon mainnet scheduled for July 31, which will introduce smart-contract functionality on the network,” Thielen said in an email.

XRD rallied over 15% on March 23, when the fundraising was announced, and began a near-vertical rise a week later after Radix rolled out the “Release Candidate” network, or RCNet, bringing a highly anticipated upgrade a step closer.

The upgrade, called “Babylon,” will introduce smart-contract capabilities to Radix, allowing developers to create powerful decentralized applications. As of last month, Radix had more than 50 projects developing applications and tools for gaming, trading, lending, non-fungible tokens and wallets.

Babylon will natively support liquid staking of XRD, eliminating the need for separate protocols like Lido, which help ether stakers retain the liquidity of their coins by issuing staked ether tokens. Staking refers to locking coins in the blockchain to boost network security in return for rewards.